7月美联储会议纪要

市场对于上周三发布的美联储会议纪要异常安静。这不但是说股市债市未见大幅波动,更重要的是,媒体并没有做详细报道,尤其是我关注的Bloomberg。秉承着“闷声发大财”的原则,我认为不被报道的信息就是最好的信息。我们一起看看会议纪要里到底有什么内容。总结一下,美联储的技术官员提供的信息表明,虽然目前金融系统与私人部门的资产负债表都比较健康,不存在系统性风险,但是受消费疲软和信贷收紧的影响,经济下行压力增加;虽然TIPS所反映的未来通胀走低,但技术官员给出的建议是通胀在未来仍倾向于上升。这些基本也是FOMC政策制定者认同的观点。政策制定者的讨论中,我觉得最有价值的是最后三段话:Participants judged that a significant risk facing the Committee was that elevated inflation could become entrenched if the public began to question the Committee's resolve to adjust the stance of policy sufficiently. If this risk materialized, it would complicate the task of returning inflation to 2 percent and could raise substantially the economic costs of doing so. 与会者认为,美联储面临的一个巨大的风险就是,当公众开始怀疑美联储加息治理通胀的决心后,通胀会更加难以控制。如果公众真的开始这么想,那么回到2%的通胀目标将变得非常复杂,且将让美国经济付出更大的代价。其实这段话说的就是在六月与七月间,美国市场中认为美联储将要提前停止加息的声音抬头,会对美联储控制通胀的任务带来巨大的麻烦。麻烦之一就是,宣传软着陆与通胀降温会通过抬高民众的预期收入来刺激消费与(非理性)投资。Many participants remarked that, in view of the constantly changing nature of the economic environment and the existence of long and variable lags in monetary policy's effect on the economy, there was also a risk that the Committee could tighten the stance of policy by more than necessary to restore price stability. These participants highlighted this risk as underscoring the importance of the Committee's data-dependent approach to judging the pace and magnitude of policy firming over coming quarters.很多与会者提到,由于经济形势是在不断变化的,并且货币政策的传导具有延迟性,美联储的货币政策也有可能为了对抗通胀而过度紧缩。为了避免这个风险,美联储应该依照经济数据对未来几个季度的紧缩步伐与幅度进行调整。这句话其实是过去一个月美股大涨的政策背景。虽然宏观前景仍然有很大的不确定性,但是提出依照数据来调整加息政策,而不是用前瞻指引的思路来确定未来的加息路径,给了美联储一个市场需要的“台阶”。而卖方经济学家们,也可以根据这个“台阶”,告诉他们的客户,最近的上涨其实不是由于哪个阴谋家为了吸引韭菜进场,不是量化交易员为了实现仓位风险中性的技术反弹,也不是为了将点位拉到期权行权价之上的合谋操作,而是有央行背书的理性行为。Participants reaffirmed their strong commitment to returning inflation to the Committee's 2 percent objective. Participants agreed that a return of inflation to the 2 percent objective was necessary for sustaining a strong labor market. Participants remarked that it would likely take some time for inflation to move down to the Committee's objective. Participants added that the course of inflation would be influenced by various nonmonetary factors, including developments associated with Russia's war against Ukraine and with supply chain disruptions. Participants recognized that policy firming could slow the pace of economic growth, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis.最后一段:与会者重申了他们对于将通胀打回2%的强烈意愿,并认为,通胀回到2%是让劳动市场保持健康的前提条件。与会者提到,让通胀回落需要一定的时间,且受到诸多非货币因素的影响,包括俄乌战争与供应链问题。与会者承认,紧缩政策不可避免的会带来经济降速,但是,回到2%的通胀目标对于保持就业最大化至关重要。但是,如果卖方经济学家们肯再多说一嘴,应该提到:央行认为通胀回落是就业稳固的前提条件通胀回落多快没有定数,且货币政策不完全决定其变化美联储会议纪要通篇都在说,通胀没有到达拐点,且有较大的向上空间。附录A:美联储会议纪要摘要Developments in Financial Markets and Open Market OperationsMarket-based measures of near-dated inflation compensation declined and continued to suggest that inflation would ease in the coming quarters.In the Desk surveys, respondents also expected inflation to decline substantially in 2023 but assigned meaningful probabilities to a wide range of potential outcomes, including scenarios involving continued elevated rates of inflationNearly all respondents to the Desk survey anticipated a 75 basis point increase in the target range at the current meeting, and most expected a 50 basis point increase in September to followThe market-implied path of the federal funds rate indicated a peak policy rate of around 3.4 percent, significantly lower than at the time of the June meeting.Along lines similar to U.S. developments, market-implied policy rates in most advanced foreign economies fell at longer horizons and reflected expectations that policy rates would reach peak levels by early 2023.The deputy manager anticipated that, in the near term, the evolution of take-up at the ON RRP facility would continue to depend on changes in the supply of safe, short-term investments, and the demand for such investments by money market mutual funds (MMMFs)Treasury coupon principal payments would first fall below the $60 billion cap in September, with the remainder of redemptions met with maturities of Treasury bills. Paydowns of agency mortgage-backed securities (MBS) were projected to fall below the higher September cap of $35 billion beginning in September.Staff Review of Financial SituationsOver the intermeeting period, nominal and real Treasury yields declined significantly, reportedly reflecting increased investor concerns about downside risks to the growth outlook as well as a decline in inflation compensation.Broad equity price indexes were higher over the intermeeting period, amid heightened volatility. Declines in interest rates likely supported stock prices over the period, while some positive earnings releases suggested to investors a less pessimistic corporate outlook.Investors' concerns about global economic growth intensified amid weaker-than-expected data on economic activity and uncertainty about the supply of natural gas from Russia to Europe.Secured overnight rates remain

市场对于上周三发布的美联储会议纪要异常安静。这不但是说股市债市未见大幅波动,更重要的是,媒体并没有做详细报道,尤其是我关注的Bloomberg。秉承着“闷声发大财”的原则,我认为不被报道的信息就是最好的信息。我们一起看看会议纪要里到底有什么内容。

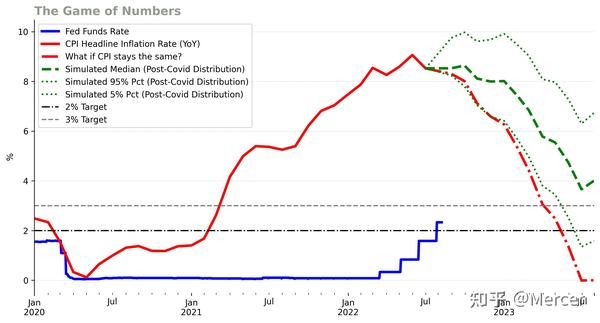

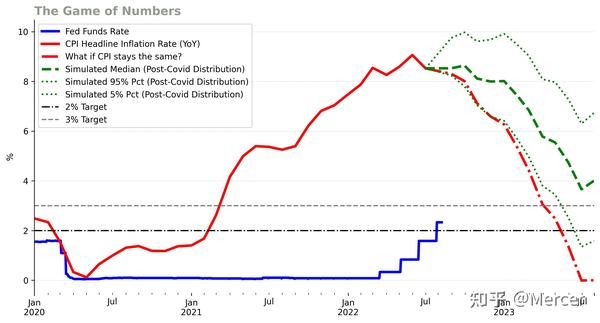

总结一下,美联储的技术官员提供的信息表明,虽然目前金融系统与私人部门的资产负债表都比较健康,不存在系统性风险,但是受消费疲软和信贷收紧的影响,经济下行压力增加;虽然TIPS所反映的未来通胀走低,但技术官员给出的建议是通胀在未来仍倾向于上升。这些基本也是FOMC政策制定者认同的观点。

政策制定者的讨论中,我觉得最有价值的是最后三段话:

Participants judged that a significant risk facing the Committee was that elevated inflation could become entrenched if the public began to question the Committee's resolve to adjust the stance of policy sufficiently. If this risk materialized, it would complicate the task of returning inflation to 2 percent and could raise substantially the economic costs of doing so.

与会者认为,美联储面临的一个巨大的风险就是,当公众开始怀疑美联储加息治理通胀的决心后,通胀会更加难以控制。如果公众真的开始这么想,那么回到2%的通胀目标将变得非常复杂,且将让美国经济付出更大的代价。

其实这段话说的就是在六月与七月间,美国市场中认为美联储将要提前停止加息的声音抬头,会对美联储控制通胀的任务带来巨大的麻烦。麻烦之一就是,宣传软着陆与通胀降温会通过抬高民众的预期收入来刺激消费与(非理性)投资。

Many participants remarked that, in view of the constantly changing nature of the economic environment and the existence of long and variable lags in monetary policy's effect on the economy, there was also a risk that the Committee could tighten the stance of policy by more than necessary to restore price stability. These participants highlighted this risk as underscoring the importance of the Committee's data-dependent approach to judging the pace and magnitude of policy firming over coming quarters.

很多与会者提到,由于经济形势是在不断变化的,并且货币政策的传导具有延迟性,美联储的货币政策也有可能为了对抗通胀而过度紧缩。为了避免这个风险,美联储应该依照经济数据对未来几个季度的紧缩步伐与幅度进行调整。

这句话其实是过去一个月美股大涨的政策背景。虽然宏观前景仍然有很大的不确定性,但是提出依照数据来调整加息政策,而不是用前瞻指引的思路来确定未来的加息路径,给了美联储一个市场需要的“台阶”。而卖方经济学家们,也可以根据这个“台阶”,告诉他们的客户,最近的上涨其实不是由于哪个阴谋家为了吸引韭菜进场,不是量化交易员为了实现仓位风险中性的技术反弹,也不是为了将点位拉到期权行权价之上的合谋操作,而是有央行背书的理性行为。

Participants reaffirmed their strong commitment to returning inflation to the Committee's 2 percent objective. Participants agreed that a return of inflation to the 2 percent objective was necessary for sustaining a strong labor market. Participants remarked that it would likely take some time for inflation to move down to the Committee's objective. Participants added that the course of inflation would be influenced by various nonmonetary factors, including developments associated with Russia's war against Ukraine and with supply chain disruptions. Participants recognized that policy firming could slow the pace of economic growth, but they saw the return of inflation to 2 percent as critical to achieving maximum employment on a sustained basis.

最后一段:与会者重申了他们对于将通胀打回2%的强烈意愿,并认为,通胀回到2%是让劳动市场保持健康的前提条件。与会者提到,让通胀回落需要一定的时间,且受到诸多非货币因素的影响,包括俄乌战争与供应链问题。与会者承认,紧缩政策不可避免的会带来经济降速,但是,回到2%的通胀目标对于保持就业最大化至关重要。

但是,如果卖方经济学家们肯再多说一嘴,应该提到:

- 央行认为通胀回落是就业稳固的前提条件

- 通胀回落多快没有定数,且货币政策不完全决定其变化

- 美联储会议纪要通篇都在说,通胀没有到达拐点,且有较大的向上空间。

附录A:美联储会议纪要摘要

Developments in Financial Markets and Open Market Operations

- Market-based measures of near-dated inflation compensation declined and continued to suggest that inflation would ease in the coming quarters.

- In the Desk surveys, respondents also expected inflation to decline substantially in 2023 but assigned meaningful probabilities to a wide range of potential outcomes, including scenarios involving continued elevated rates of inflation

- Nearly all respondents to the Desk survey anticipated a 75 basis point increase in the target range at the current meeting, and most expected a 50 basis point increase in September to follow

- The market-implied path of the federal funds rate indicated a peak policy rate of around 3.4 percent, significantly lower than at the time of the June meeting.

- Along lines similar to U.S. developments, market-implied policy rates in most advanced foreign economies fell at longer horizons and reflected expectations that policy rates would reach peak levels by early 2023.

- The deputy manager anticipated that, in the near term, the evolution of take-up at the ON RRP facility would continue to depend on changes in the supply of safe, short-term investments, and the demand for such investments by money market mutual funds (MMMFs)

- Treasury coupon principal payments would first fall below the $60 billion cap in September, with the remainder of redemptions met with maturities of Treasury bills.

- Paydowns of agency mortgage-backed securities (MBS) were projected to fall below the higher September cap of $35 billion beginning in September.

Staff Review of Financial Situations

- Over the intermeeting period, nominal and real Treasury yields declined significantly, reportedly reflecting increased investor concerns about downside risks to the growth outlook as well as a decline in inflation compensation.

- Broad equity price indexes were higher over the intermeeting period, amid heightened volatility. Declines in interest rates likely supported stock prices over the period, while some positive earnings releases suggested to investors a less pessimistic corporate outlook.

- Investors' concerns about global economic growth intensified amid weaker-than-expected data on economic activity and uncertainty about the supply of natural gas from Russia to Europe.

- Secured overnight rates remained soft relative to the ON RRP offering rate, with the downward pressure on rates attributed to continuing declines in net Treasury bill issuance, elevated demand for collateral in the form of Treasury securities, and MMMFs maintaining very short portfolio maturities amid uncertainty about the near-term outlook for policy rate increases. Consistent with the downward pressure on repo rates, daily take-up in the ON RRP facility increased.

- Sovereign yields and medium-term inflation compensation measures in major AFEs, most notably in the euro area, moved down

- In the euro area, peripheral sovereign spreads were little changed following the widely anticipated announcement by the European Central Bank of its Transmission Protection Instrument that could be activated to counter disorderly conditions in euro-area bond markets

- In domestic credit markets, longer-term borrowing costs for households and businesses with higher credit ratings declined over the intermeeting period but borrowing costs for lower-rated firms were higher, on net. The credit quality of businesses, municipalities, and households remained stable.

- Borrowing costs linked to shorter-term interest rates generally increased, largely as a result of expectations of tighter monetary policy.

- The credit quality of nonfinancial corporations remained strong with low volumes of defaults on corporate bonds in May and on leveraged loans in June. The volume of rating downgrades on speculative-grade credit in the corporate bond market was similar to that of upgrades in June, while for leveraged loans, the volume of downgrades exceeded the volume of upgrades in May and June.

- Credit card and auto credit delinquency rates rose somewhat over the first quarter but remained subdued by recent historical standards.

- Business loans at banks expanded at a rapid pace in May and June, despite higher interest rates and a more uncertain economic outlook. C&I loans on banks' books continued to grow robustly, with the July SLOOS citing reasons of increased demand by customers to finance inventory and accounts receivable.

- The staff provided an update on its assessment of the stability of the financial system and, on balance, characterized the vulnerabilities of the U.S. financial system as moderate, down from notable in January.

- The staff assessed that households were in a better position than in the mid-2000s to weather a downturn in house prices ... In addition, the staff assessed that business leverage was high, but businesses maintained ample cash on hand and their credit quality remained strong. Further, the ability of most firms to service their debt was at a historically high level, as measured by the interest coverage ratio.

- The staff assessed that leverage in the financial sector remained moderate ... the recently concluded stress tests suggested that participating banks could absorb losses from a severe recession without breaching regulatory minimums

- Yields offered by MMMFs were well above those offered by banks, and the staff noted that this yield differential would attract inflows to MMMFs. Noting the structural vulnerabilities associated with MMMFs, the staff highlighted the need to monitor the size and fragility of this sector and the progress of the Security and Exchange Commission's recently proposed reforms. The staff noted that open-end bond and loan mutual funds, which are also vulnerable to large-scale investor withdrawals, had experienced outflows as interest rates rose. These outflows had proceeded in an orderly manner.

Staff Economic Outlook

- The projection for U.S. economic activity prepared by the staff for the July FOMC meeting was noticeably weaker than the June forecast, reflecting the economy's reduced momentum and current and prospective financial conditions that were expected to provide less support to aggregate demand growth.

- As a result, while the projected level of real GDP remained above potential this year, the gap was expected to have closed by the second half of 2023.

- Similarly, the unemployment rate was projected to start rising in the second half of 2022 and to reach the staff's estimate of its natural rate at the end of next year.

- (此处省略一万字的 inflation bullshits)

- The staff continued to judge that the risks to the baseline projection for real activity were skewed to the downside, noting that supply chain bottlenecks, Russia's war against Ukraine, weak incoming data on spending, and the tightening in financial conditions since the start of the year supported this assessment.

- The staff viewed the risks to the inflation projection as skewed to the upside given the persistent upward surprises seen in the inflation data, the possibility that inflation expectations would become unanchored as a result of the large increase in actual inflation over the past year, and the risk that supply conditions would not improve as much as the baseline projection assumed.

Participants' Views on Current Conditions and the Economic Outlook

- Participants observed that the labor market remained strong ... many participants also noted, however, that there were some tentative signs of a softening outlook for the labor market

- Participants noted that indicators of spending and production pointed to less underlying strength in economic activity than was suggested by indicators of labor market activity. With employment growth still strong, the weakening in spending data implied unusually large negative readings on labor productivity growth for the year so far.

- Participants remarked that, although recent declines in gasoline prices would likely help produce lower headline inflation rates in the short term, declines in the prices of oil and some other commodities could not be relied on as providing a basis for sustained lower inflation, as these prices could quickly rebound

- Participants agreed that there was little evidence to date that inflation pressures were subsiding. They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time.

- Uncertainty about the medium-term course of inflation remained high, and the balance of inflation risks remained skewed to the upside.

- Participants saw the risks to the outlook for real GDP growth as primarily being to the downside.

- Participants remarked that moving to a restrictive stance of the policy rate in the near term would also be appropriate from a risk-management perspective because it would better position the Committee to raise the policy rate further, to appropriately restrictive levels, if inflation were to run higher than expected.

来源:知乎 www.zhihu.com

作者:知乎用户(登录查看详情)

【知乎日报】千万用户的选择,做朋友圈里的新鲜事分享大牛。 点击下载

![【XGAMER 元代碼 - 主題曲: 寂聲 (日本語)】 日語歌詞: Verse 1 目を閉じたいだけ 気にしていないふうに... 内の信念は 正しくない 風と海[真実を]告げて 失くしない 幻がなくて Chorus: 徹夜で戦った 日差し...](https://scontent.fdsa2-1.fna.fbcdn.net/v/t15.5256-10/336656091_162215126698640_3843734250325810940_n.jpg?stp=dst-jpg_p600x600&_nc_cat=102&ccb=1-7&_nc_sid=08861d&_nc_ohc=kQATFNXRo-kAX9EeaEw&_nc_ht=scontent.fdsa2-1.fna&oh=00_AfCnUOW2Bv6j_cgJTtG7RU2CcjvsthXu1Pj6XjGBE5943w&oe=641C69A7#)